What does it take to develop a fleet management budget that will support you on the way to your business goals? In this short guide will cover the determining aspects you should keep in mind and strategies to employ when drawing up a fleet budget.

But first, let’s clarify — why is it imperative to have one? 🤔

Why do you need to draw up a fleet budget?

Implementing a comprehensive fleet budget helps companies better manage their fleet operations, improve efficiency, and support their overall business objectives.

1. Review your past expenses

To have a solid foundation for fleet operations optimization and cost management, it’s advisable to first analyze your expenses over the last few years. Segment this data and pinpoint what your organization was spending the most on, and where cost reductions should be made. It’s even better if you can turn to numbers recorded over quarter periods rather than years for more accuracy.

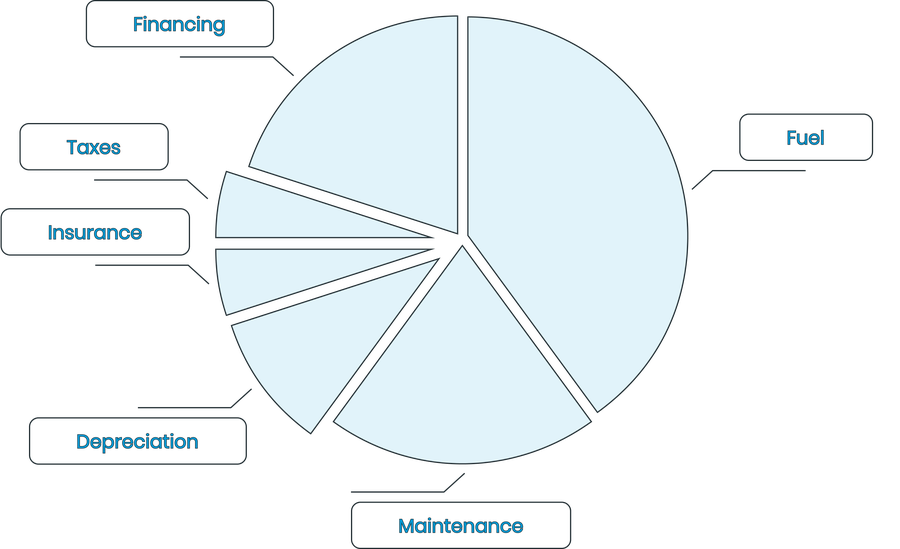

It’s best to divide this data into fixed and variable costs.

Lastly you combine all the individual costs to get the total cost of fleet ownership for that period. You can then refer to this metric and measure changes in expenses in the future.

2. Outline objectives

Once you have a clear picture of the types of expenses that had to be financed and evaluate the relative amount allocated for those costs, you can begin to set clear objectives to improve your budgeting. This could mean aiming to lower maintenance or fuel fees.

3. Leverage the power of forecasting

Forecasting future operational costs is key to developing an efficient, fool-proof fleet budget that makes sure your company’s prepared for what’s to come. Let’s compare the two main ways to forecast: incremental and zero-based.

Incremental forecasting uses your past expense history as a basis for future predictions and the previous recorded period as a starting point. It accounts for anomalies and inflation.

Pros: This method is easy and fast, you can apply it over and over.

Cons: There is difficulty with picking up on market fluctuations.

In zero-based forecasting, each period begins anew with a blank slate. The forecast is constructed by incorporating known expenses and market-driven inputs.

Pros: This method is more accurate and sensitive to market fluctuations.

Cons: Increased time expenditure and difficulty.

4. Ensure easy means of tracking

To streamline the process and workflow of fleet budget management, a practical solution would be to invest in means of tracking expenses. Budgeting is impossible without accurate data, so consider a convenient fleet management software to stay on top of operational costs. Not only can you monitor where your budget goes, but you’re also provided with detailed reports with valuable expense insights, cost analysis, and fleet operation optimization, such as finding better driving routes.

Scour the market for fleet budget management tools that best fit your needs, are within your cost range, and whose features bring your organization closer to reaching its goals.

In Conclusion

What fleet budgeting mainly boils down to is being able to accurately monitor and track operational expenses, compile and analyze data (possibly along with previous periods) and build on top of that.

Whether it’s to set objectives for future company expense distribution or forecast using the incremental or zero-based method. Use these guidelines to effectively create an all-encompassing fleet budget, that also ensures you’re prepared for possible fluctuations in the market, macroeconomic changes, or anomalies.